Australia

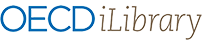

Total employment in the OECD returned to pre-crisis levels at the end of 2021 and continued to grow in the first months of 2022. The OECD unemployment rate gradually fell from its peak of 8.8% in April 2020 to a level of 4.9% in April 2022, slightly below the 5.3% value recorded in December 2019. However, the labour market recovery has been uneven across countries and sectors and is still incomplete, while its sustainability is challenged by the economic fallout Russia’s unprovoked, unjustified, and illegal war of aggression against Ukraine.

Australia has made a strong recovery from the COVID-19 crisis, with the unemployment rate declining to 3.4% in July 2022 – below its pre-pandemic rate of 5.1%. The employment rate (for the population aged 15 and over) was 3.1 percentage points higher in July than at the end of 2019. Like most OECD countries, job retention schemes contributed to mitigating many of the negative employment effects of the crisis, along with stringent border controls which helped limit the initial spread of the virus.

Despite new outbreaks of the COVID-19 virus, the Australian labour market has remained resilient and experienced strong employment growth in the first months of 2022. Consequently, unemployment and underemployment rates have reached exceptionally low levels. However, the recovery has been unevenly distributed. Employment growth has varied considerably across different skill levels, and employment in lower skill level occupations (ANZSCO Skill Level 3-5) decreased by 2.3% between February 2020 and February 2022. While young adults were disproportionately affected by the pandemic, they have experienced a stronger recovery than older adults.

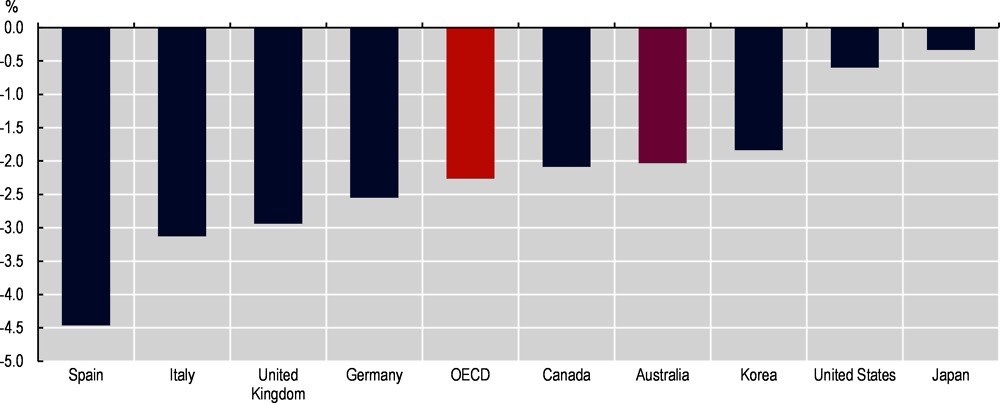

Vacancies surged to record highs in the OECD area, and reports of labour shortages rose significantly in many industries and countries. Despite this, nominal wage growth remains well below the high inflation induced by the commodity price hikes spurred by Russia’s war of aggression against Ukraine. The decline in real wages is expected to continue over the course of 2022, as inflation is projected to remain well above the negotiated nominal wages for 2022.

Australia has experienced a surge in vacancies, surpassing pre-pandemic levels by November 2020, less than one year since the onset of the crisis. Australia continues to experience one of the highest increases in vacancies in the OECD, and by May 2022 vacancies in Australia were more than double their pre-crisis levels.

Australia’s labour market is now tighter than it was prior to the pandemic, as seen by a sharp rise in the vacancy-to-employment ratio in Australia. Despite a tight labour market, nominal wage growth in 2022 is projected to remain lower than price inflation, effectively resulting in a projected 2% reduction in real wages in Australia, slightly less than the OECD average (2.3%).

Labour market concentration, where few employers compete for workers, contributes to employer monopsony power. Monopsonistic employers can set wages unilaterally, leading to lower employment and wages. The largest cross-country analysis to date shows that 16% of workers are employed in at least moderately concentrated labour markets. Reducing anticompetitive practices and expanding collective bargaining, among other policies, can curb monopsony power.

Australia’s business sector is slightly more concentrated than the OECD average, with 18% of Australian employees working in concentrated labour markets (in contrast to 16% average across the OECD). With the working population scattered across a large area, geography plays a big role in labour market concentration. 47% of employees in Australia’s rural areas are working in concentrated labour markets, well above the OECD average of 29% and a rate four times higher than in urban areas.

As the labour market becomes more concentrated, employers require more skills from workers in similar jobs, reducing job opportunities for workers with fewer skills. In Australia, a 10% increase in labour market concentration leads to a 1.4% increase in number of skill categories required in the job advertisement. Estimates show that a moderate retraining effort has the potential to reduce aggregate labour market concentration by 14% in Australia by helping workers move to less concentrated occupations, suggesting that reskilling and retraining policies can play a role in improving labour market conditions where markets are monopsonistic.