America Has a Resilience Problem

The chair of the Federal Trade Commission makes the case for competition in an increasingly consolidated world.

The Federal Trade Commission (FTC) enforces the nation’s antitrust and consumer protection laws. We focus primarily on domestic markets and the U.S. economy. Through this work, we get a ground-level view of how markets are structured in America—and of how the extent of competition or consolidation drives outcomes that affect us all.

The Federal Trade Commission (FTC) enforces the nation’s antitrust and consumer protection laws. We focus primarily on domestic markets and the U.S. economy. Through this work, we get a ground-level view of how markets are structured in America—and of how the extent of competition or consolidation drives outcomes that affect us all.

Like many across government, the FTC is watching closely as the release of sophisticated AI tools creates both opportunities and risks. Our work is already tackling the day-to-day harms these tools can turbocharge, from voice-cloning scams to commercial surveillance.

But beyond these immediate challenges, we face a more fundamental question of power and governance. Will this be a moment of opening up markets to free and fair competition, unleashing the full potential of emerging technologies? Or will a handful of dominant firms concentrate control over key tools, locking us into a future of their choosing?

The stakes of how we answer this question are enormously high. Technological breakthroughs can disrupt markets, spur economic growth, and change the nature of war and geopolitics. Whether we opt for a national policy of consolidation or of competition will have huge consequences for decades to come.

As in prior moments of contestation, we are starting to hear the argument that America must protect its domestic monopolies to ensure we stay ahead on the global stage. Rather than double down on promoting free and fair competition, this “national champions” argument holds that coddling our dominant firms is the path to maintaining global dominance.

We should be extraordinarily skeptical of this argument and instead recognize that monopoly power in America today is a major threat to America’s national interests and global leadership. History and experience show that lumbering monopolies mired in red tape and bureaucratic inertia cannot deliver the breakthrough technological advancements that hungry start-ups tend to create. It is precisely these breakthroughs that have allowed America to harness cutting-edge technologies and have made our economy the envy of the world. To stay ahead globally, we don’t need to protect our monopolies from innovation—we need to protect innovation from our monopolies. And one of the clearest illustrations of how consolidation threatens our national interests is the risk monopolization poses to our common defense.

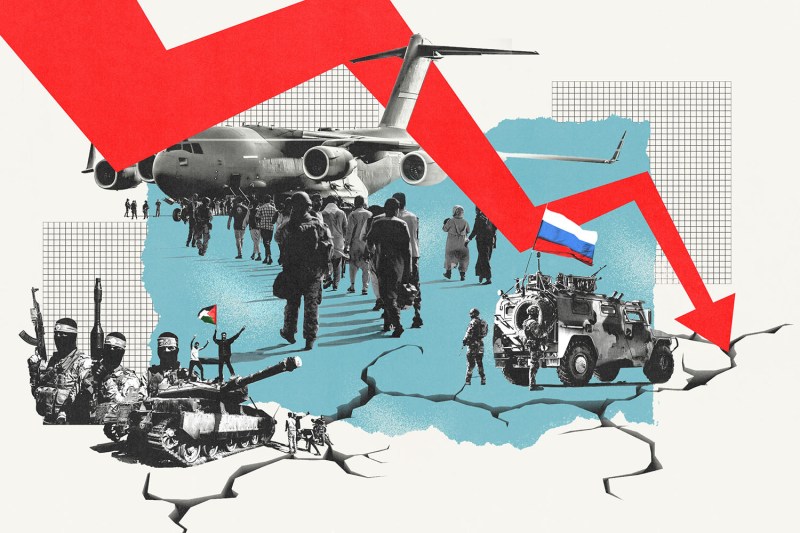

U.S. airmen load pallets with baby formula from Switzerland bound for the United States during a baby formula shortage in the U.S., at Ramstein Air Base in Germany on May 21, 2022. Thomas Lohnes/Getty Images

In 2021, an errant spark in an explosives factory in Louisiana destroyed the only plant in the United States that makes black powder, a highly combustible product that is used to make mortar shells, artillery rounds, and Tomahawk missiles. There is no substitute for black powder, and it has hundreds of military applications. So when that factory blew up, and we didn’t have any backup plants, it destroyed the only black powder production in all of North America. There’s a simple lesson here: Don’t put all your eggs in one basket.

This is but one of many examples of how consolidation threatens our national interests. We know that monopolies and consolidated markets can result in higher prices and lower output. But monopolies also foster systemic vulnerabilities, since concentrating production also concentrates risk. Someone could probably argue it was more efficient to put all black powder production in one plant in Louisiana. And maybe it was—until it wasn’t.

Defense officials now identify the problem of monopoly in our country as a strategic weakness. The Pentagon has been warning about vulnerabilities in our national security supply chain for years. One top official recently noted that our increased reliance on a small number of contractors for critical capabilities impacts our ability to ramp up production.

One early victory in my tenure as FTC chair was blocking the proposed merger between Lockheed and Aerojet. Aerojet is the last independent U.S. supplier of key missile inputs, and our investigation showed that the deal would have allowed Lockheed to cut off rivals’ access to this key input and jack up the price that our government, and ultimately the public, has to pay. It was the first time in decades that our government sued to halt consolidation in the defense industrial base.

It’s not just our defense industrial base where we have a problem. The pandemic exposed fragilities across our supply chains, with shortages in everything from semiconductors to personal protective equipment. And it’s not just a once-in-a-century pandemic. Even more routine disruptions like plant contaminations or hurricanes have revealed how, in a concentrated system, a single shock can have cascading effects, yielding shortages in products ranging from baby formula to IV bags.

Consolidation causes problems beyond supply chains. For years, successive administrations have sought to strengthen our cybersecurity defenses against a catastrophic attack. A few weeks ago, one of the main medical benefit claims networks in America, Change Healthcare, was taken down for weeks due to a cyberattack, depriving hospitals and medical providers of the ability to bill for their services—and wreaking havoc across our health care system. That network is owned by UnitedHealth Group, which was allowed to buy Change despite a Department of Justice lawsuit seeking to block the deal. Quite simply, we have a resiliency problem in America. Consolidation and monopolization have left us more vulnerable and less resilient in the face of shocks.

But what about AI and the innovation economy? Black powder and baby formula shortages are one thing, but the corporations that run big data centers and large language models are highly technical operations, with tens of billions of dollars of capital to deploy, trillions in market capitalization, and some of the most highly skilled professionals.

Again, we should be guided by history. In the 1970s, Walter Wriston, the CEO of Citibank and a key leader on Wall Street, asked why antitrust enforcers were filing suits against high-tech American darlings like IBM and AT&T: “What is the public good of knocking IBM off?” he said. “The conclusion to all this nonsense is that people cry, ‘Let’s break up the Yankees—because they are so successful.’” By contrast, Europe and Japan were protecting their national champions to win in the international arena.

We chose to promote competition, and that choice to bring antitrust lawsuits against IBM and AT&T ended up fostering waves of innovation—including the personal computer, the telecommunications revolution, and the logic chip. The national champions protected by Japan and Europe, meanwhile, fell behind and are long forgotten. In the United States, we bet on competition, and that made all the difference.

Imagine a different world, where today’s giants never had a chance to get their start and innovate, because policymakers decided that it was more important to protect IBM and AT&T from competition and allowed them to maintain their monopolies. Even when monopolies do innovate, they will often prioritize protecting their existing market position. Famously, an engineer at Kodak invented the first portable digital camera in the ’70s—but Kodak didn’t rush it to market in part because it didn’t want to cannibalize its existing sales. More generally, significant research shows that while monopolies may help deliver marginal innovations, breakthrough and paradigm-shifting innovations have historically come from disruptive outsiders. It is our commitment to free and fair competition that has allowed America to harness the talents of its citizens, reap breakthrough innovations, and lead as an economic powerhouse. But what about those times when we have accepted the national champions argument? One prominent example serves as a cautionary tale.

Boeing 727 and 737 airplanes are seen on the production line at a factory in Renton, Washington, in 1977. AFP via Getty Images

In the 1990s, a White House advisor noted that there was one very high-tech firm that was “de facto national champion,” so important that “you can be an out-and-out advocate for it” in government. And we did support it, provide it with government contracts, and allow it to consolidate the industry. That national champion was Boeing, whose trajectory illustrates why this strategy can be catastrophic.

In 1997, Boeing became the only commercial aerospace maker in the United States. It came to enjoy this status after buying up McDonnell Douglas, the only other domestic producer of commercial airplanes—a merger reviewed by the FTC. Boeing is the clearest example of a purposeful decision to bet on national champions on behalf of American interests. Policymakers wanted a national champion, and they got it.

Three things happened after Boeing eliminated its domestic competition. First, according to commenters such as United Airlines CEO Scott Kirby, the merger allowed Boeing to slow innovation and to reduce product quality. Boeing’s R&D budget is consistently lower than that of its only rival, Airbus. Worse quality is one of the harms that most economists expect from monopolization, because firms that face little competition have limited incentive to improve their products.

Second, reporting suggests that Boeing executives began to view their knowledgeable workforce as a cost, not an asset, with tragic outcomes. As one consultant put it in 2000, “Boeing has always been less a business than an association of engineers devoted to building amazing flying machines.” This corporation’s engineers designed the B-52 in a single weekend. But the new post-merger Boeing decimated its workforce, offshored production, and demanded wage concessions.

Third is the risk that Boeing effectively became too big to fail and a point of leverage for countries seeking to influence U.S. policymaking.

Relying on a national champion creates supply chain weaknesses and taxpayer liabilities, but it also creates geopolitical vulnerabilities that can be exploited both by global partners and rivals. As it was buying McDonnell Douglas, Boeing held a board meeting in Beijing and lobbied Congress to end the annual review of China’s trading rights so that it could sell more planes. The Chinese government would order Boeing planes contingent upon certain U.S. policies, like whether the U.S. held off on sending warships into the Strait of Taiwan, or whether the U.S. lifted bans on the export of certain technologies.

National champions are still corporations first. They have earnings calls, shareholders, and quarterly profit targets. When policymakers in Washington decide to back a single monopoly, their objectives are but one concern among many for that corporation’s senior executives. As then-Exxon CEO Lee Raymond said, “I’m not a U.S. company and I don’t make decisions based on what’s good for the U.S.”

These days, the national champions argument often gets made in the context of our dominant tech firms. We often hear that pursuing antitrust cases against or regulating these firms will weaken American innovation and cede the global stage to China. These conversations often assume a Cold War-like arms race, with each country’s firms in a zero-sum quest for dominance.

The reality today is that some of these same tech firms are fairly integrated in China and are seeking greater access to the Chinese market. While there is nothing intrinsically improper about these ties, we should be clear-eyed about how they shape business incentives. Various incidents in recent years have highlighted how when U.S. corporations are economically dependent on China, it can spur them to act in ways that are contrary to our national interests.

Even if America’s dominant firms are not prioritizing America’s national interests, what should we make of the idea that they can keep America in the lead, if only they are left alone? This, too, is an argument we should treat with great skepticism.

We need to choose competition over national champions, and there are steps we are taking to put that into practice.

Nvidia President Jen-Hsun Huang delivers a keynote address at CES 2017 in Las Vegas on Jan. 4, 2017.Ethan Miller/Getty Images

In 2021, the FTC sued to block Nvidia’s $40 billion acquisition of Arm, what would have been the largest semiconductor chip merger in history. Our investigation found that the merger would’ve allowed a major chip provider to control key computing technologies that rival firms depend on to develop their own competing chips. Our lawsuit alleged the deal would have risked stifling the innovation pipeline for next-generation technologies, affecting everything from data centers to self-driving cars. Two years on, Nvidia has continued to provide innovative products at a lower cost than we estimated they would have charged businesses after completing the acquisition of Arm. Arm itself is thriving, with its stock price doubling since it went public last year.

This is but the latest example of antitrust laws in action. The FTC was created in part to protect the innovative boons of open markets by ensuring that market outcomes—who wins and who loses—are determined by fair competition rather than by private gatekeepers. Protecting open and competitive markets means that the best ideas win. It means that businesses get ahead by competing on the merits of their skill, not by exploiting special privileges or bowing down to incumbent monopolists.

One final argument against protecting monopolies over competition is that it can leave our democracy more brittle.

Over the last couple of years, I’ve had the chance to hear from thousands of people across America—from nurses, farmers, and grocery store workers to tech founders, hotel franchisees, and writers in Hollywood. A recurring theme across their stories is a sense of fear, anxiety, and powerlessness. People from strikingly different walks of life have shared accounts of how markets monopolized by dominant middlemen enable coercive tactics—of how they feel their ability to make a decent living or thrive in their craft is, too often, not a function of their talents or diligence but instead is dictated by the arbitrary whims of distant giants.

A basic tenet of the American experiment is that real liberty means freedom from economic coercion and from the arbitrary, unaccountable power that comes with economic domination. Our antitrust laws were passed as a way to safeguard against undue concentration of power in our economic sphere, just as the Constitution creates checks and balances to safeguard against concentrated power in our political sphere.

Recommitting to robust antitrust enforcement and competition policy is good for America because it will make us safer, our technologies more innovative, and our economy more prosperous—but also because it is essential for safeguarding real opportunity for Americans and for ensuring that people in their day-to-day dealings experience liberty rather than coercion. When people believe that government has stopped fighting on their behalf, it can become a strategic weakness that outsiders are only too happy to exploit.

Thankfully, over the last few years we have seen significant progress across government in ensuring that we are centering everyday Americans in our policy decisions. From trade to industrial policy to competition, this administration has learned from past experiences and adopted new paradigms. A common throughline across these approaches is a commitment to revisiting old assumptions and updating our thinking in light of real-life experience and evidence.

Fighting back against the challenges we face is about more than enforcing the antitrust laws. But by promoting fair competition, by showing the American people that we will fight for their right to enjoy free, meaningful lives outside the grip of monopolists, we can help rebuild not just people’s confidence in the economy, but also a belief in American government, and its leadership both at home and abroad.

This article is adapted from a speech Lina Khan gave to the Carnegie Endowment for International Peace on March 13.

Lina M. Khan is the chair of the Federal Trade Commission.

More from Foreign Policy

Arab Countries Have Israel’s Back—for Their Own Sake

Last weekend’s security cooperation in the Middle East doesn’t indicate a new future for the region.

Forget About Chips—China Is Coming for Ships

Beijing’s grab for hegemony in a critical sector follows a familiar playbook.

‘The Regime’ Misunderstands Autocracy

HBO’s new miniseries displays an undeniably American nonchalance toward power.

Washington’s Failed Africa Policy Needs a Reset

Instead of trying to put out security fires, U.S. policy should focus on governance and growth.

Join the Conversation

Commenting on this and other recent articles is just one benefit of a Foreign Policy subscription.

Already a subscriber? .

Subscribe Subscribe

View Comments

Join the Conversation

Join the conversation on this and other recent Foreign Policy articles when you subscribe now.

Subscribe Subscribe

Not your account?

View Comments

Join the Conversation

Please follow our comment guidelines, stay on topic, and be civil, courteous, and respectful of others’ beliefs.